Dr John Kumah, Deputy Minister of Finance, has urged the newly reconstituted Board of the Reinsurance Company Limited (Ghana Re) to embark on an expansionary drive into targeted markets in Africa to grow its premium income.

He also asked members to enhance operational excellence and shareholder value by increasing Return on Equity from 14.8 per cent to 20 per cent by 2024.

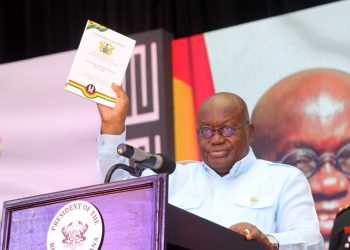

Dr Kumah said this when he inaugurated a seven-member reconstituted Board of Ghana Re being chaired by Mr George Otoo, a Chartered Insurance Practitioner.

Other members are Mr George Y. Mensah, the Managing Director of Ghana Re, Mrs Jennifer Owusu, a Lawyer, Mr Franklin Hayford, Executive Director of Financial Services Business, Mrs Lynda Odro, a Chartered Insurance Practitioner, Mrs Stella Williams, Director for Monitoring and Evaluation at the Ministry of Finance and Dr Francis Sapara-Grant, an Economist.

He implored the Governing Board to assist the management of Ghana Re in performing its functions creditably and lived up to its mandate of providing world-class reinsurance services to local and international companies.

He urged the Board to continue to provide appropriate strategic directions which would transform Ghana Re.

“We are confident of the quality of your membership, the varying degree of expertise leaves us in no doubt that the Board will live up to expectation,” he said.

He said with Teamwork and commitment, Mr Chairman would ensure that the Board meets the expectations of the Government and the general public.

He said it had been proven globally that a strong correlation exists between the level of economic development of a country and how developed the country’s insurance sector is.

“Whilst correlation does not necessarily imply causation, the benefits of a well-developed Insurance market to a country are numerous,” the Minister said.

Dr Kumah said insurance provided financial support and reduced uncertainties in business and human life, and it provided a cover against loss due to fire, marine, accidents or any sudden loss.

He said Funds generated by collecting premiums could be invested in government securities and stock for the country’s economic development.

Also, the Insurance sector provides capital for productive investments. Insurance mitigates loss, promotes financial stability and trade and commerce activities resulting in economic growth and development.

As an international reinsurer, competing with regional reinsurers who operate under charters such as Africa Re, Zep Re and WAICA Re, Ghana Re has continued to make significant strides in the industry.

Dr John Kumah said Parliament had passed the new Insurance Act, 2021 (Act 1061), which seeks to strengthen the regulatory framework of insurance businesses in Ghana in compliance with the new Insurance Core Principles introduced by the International Association Insurance Supervisors.

It is expected to position the insurance industry to meaningfully contribute to the agenda of strengthening the financial sector and deepening the financial market, improving corporate governance practices within the insurance industry, and increasing the insurance industry’s competitiveness.

Therefore, he said it was incumbent on the Board and the National Insurance Commission to ensure its implementation and enhance Ghana’s attractiveness as an insurance hub for the sub-region.

Mr Otoo expressed gratitude to President Nana Akufo-Addo for demonstrating his confidence in serving another term as Directors of Ghana Re.

In the last four years (2017 to 2020), he said, Ghana Re’s premium income steadily grew from GH¢193 million to GH¢312 million.

He said gross profit also grew from GH¢49 million in 2017 to GH¢456 million as of December 2020 (even amid the COVID-19 pandemic).

The Board Chairman said the Company also had a good history of paying dividends consistently and has, within the same four-year period, paid a total dividend of GH¢437 million to the Government, the sole shareholder.

He said the Company currently has a total market share of about 45 per cent and was working very hard to increase this steadily to about 55 per cent for general business and maintain its 80 per cent share for life business in the next three years.

“But most importantly, we will continue to provide capacity for local insurance companies to retain more premiums in the Country for development,” he added.

He said Ghana Re had established a regional office in Cameroon to cater for the Central African zone and a full subsidiary in Kenya to serve the East African market.

“Work is currently in progress to open a third office in Casablanca, Morocco, to serve the North African regional bloc,” he said.

GNA